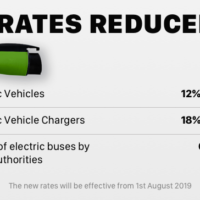

The GST Revolution Unleashed: As the globe switches gears towards a greener, cleaner future, India is making great gains in the electric vehicle (EV) revolution. The drop in the Goods and Services Tax (GST) rate on EVs from 18% to 5% has been a critical driver in this journey. This innovative step has accelerated the adoption of electric mobility, paving the path for a more sustainable future.

The GST Revolution Unleashed

Unleashed into the Benefits: The Indian government’s brave decision to reduce the GST rate on electric vehicles has had a huge impact on market dynamics. The reduction has made EVs cheaper to the average customer, boosting broad adoption and triggering a cascade of benefits.

The brave decision by the Indian government to reduce the GST rate on electric vehicles has had a huge impact on market dynamics. People should know about The GST Revolution Unleashed to increase better economic derivatives and taxes. The decrease has made EVs cheaper to the average customer, boosting wider adoption and causing a cascade of benefits. Here we have listed some benefits of The GST Revolution Unleashed.

- Increased Affordability: The lower GST rate has significantly decreased the price of electric vehicles, bringing them in line with their petrol and diesel equivalents. This financial incentive has made EVs more appealing to budget-conscious purchasers.

- Increasing Domestic Manufacturing: The tax cut has also incentivized domestic EV manufacturers, promoting a thriving ecosystem of research and manufacturing within the country. As a result, job creation and economic growth are on the rise.

- Cleaner Environment: As more people choose electric vehicles, India’s air pollution and greenhouse gas emissions are decreasing. This environmentally friendly move is critical for the country’s long-term health and well-being.

- Energy Security: India is gradually reducing its reliance on imported fossil fuels by encouraging electric mobility. This step towards energy independence increases the country’s energy security and economic resilience.

- Market Dynamics and Growth: The electrification of vehicles in India is gaining momentum, driven by advancements in battery technology, declining costs of EV components, and increasing consumer awareness of environmental sustainability. Electric two-wheelers, three-wheelers, and passenger vehicles are witnessing growing demand, supported by favorable policies and investments in charging infrastructure.

- Role of Stakeholders: Automakers, battery manufacturers, government agencies, and technology providers play pivotal roles in driving the GST revolution and electrification agenda in India. Collaborative efforts in research, development, and implementation of sustainable mobility solutions are essential to overcome barriers and capitalize on market opportunities.

The reduced GST rate for electric vehicles is only the beginning. This tax break has also been extended to EV chargers, making it easier for users to keep their vehicles charged and ready to go. Furthermore, with continued investments in charging infrastructure and favorable policies, India is poised to become a global EV powerhouse.

Conclusion: India’s GST revolution has been nothing short of revolutionary in the world of electric vehicles. The drop from 18% to 5% has opened up a whole new world of opportunities for consumers, manufacturers, and the environment alike. As the country continues to strive for a greener, cleaner future, it is apparent that the electric mobility revolution has begun, and India is at the forefront.

We hope this blog “The GST Revolution Unleashed” is helpful to you. If you want to know many more information like “The GST Revolution Unleashed” and other topics, you can read our other informative blogs.

/Also Read/

- The Astonishing Rise of Electric Vehicles: A Global Market Analysis for 2023

- The Incredible Environmental Benefits of Electric Vehicle Retrofits: From Gas Guzzler to Green Machine

- The Exciting Road to Self-Driving Cars: How Electric Vehicles Are Revolutionizing the Future

- Revolutionary Electric Micro-Mobility in Cities: From E-Bikes to E-Scooters

1 Comment

[…] The GST Revolution Unplugged: Electrifying India […]